Case Study on Trust Complexities

Brokers should always ask the question of their clients – “and are there any related Trusts?” Snapshot Borrower Rate % 9.75% p.a. LVR % 45% Loan $ $1,550,000 State Qld Property Type Residential the broker’s journey An application was presented for refinance pending sale of an unoccupied, recently constructed luxury investment property on the Queensland […]

Private Credit in 2024

Andrew Way Writes: Private Credit is essentially the provision of loans by non-bank lenders, and investment in them by retail and wholesale investors via fixed income products. These investments are distinct from traditional mortgage bonds by being private and not public holdings and largely untraded, similar but not identical to investments in unlisted asset-backed and mortgage secured mortgage funds in Australia, as with Semper.

The private credit market in Australia is estimated to be greater than $600 Billion as of 2023 (Reuters), as private credit’s market share of the loan market, particularly in commercial and development finance, outstrips banks’ appetites to lend.

Welcoming Neil D’Souza

Please join us in welcoming our new Sales Director, Neil D’Souza

Happy New Year 2024

In 2023 Semper recorded another perfect year of lending and investment management with all loans paying to contract and settling according to loan term. There were zero losses and over 30% of all loans paid out prior to term.

As we head into 2024, we would like to thank all our supporters, investors, warehouse providers, introducers and suppliers. We wish you all a successful year ahead.

Private Credit Market Shake-Up

Andrew Way writes: “2023 has been an interesting year in Private Credit… What matters now is that the market, on a rate for risk basis, has normalised. The cost of capital is once again determined by portfolio performance and strong credit policies.” Semper have a direct line to investors. Contact us today with your commercial loan enquiries.

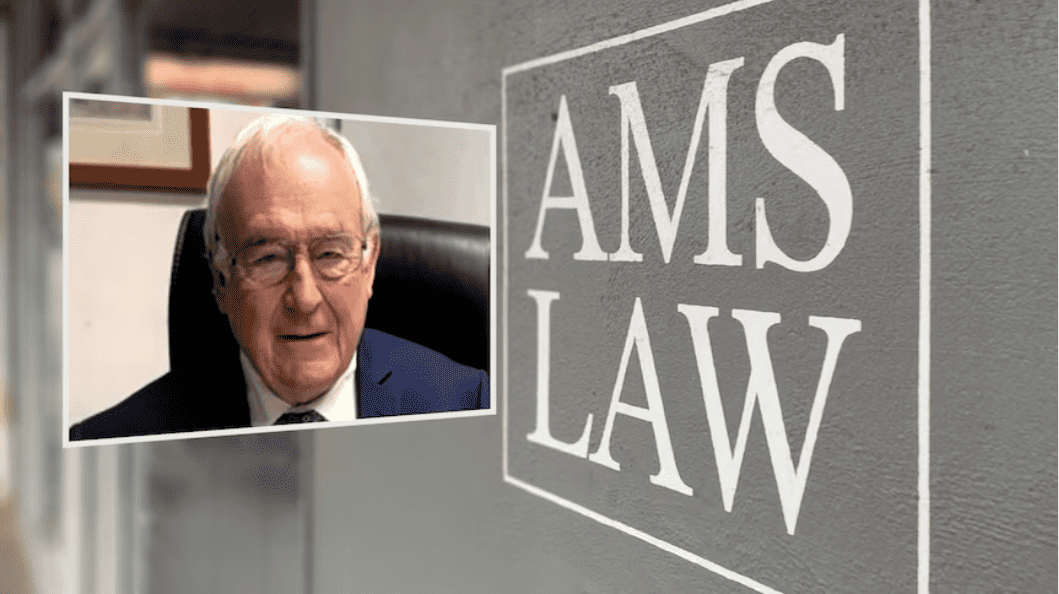

MortgageBusiness: How could alleged mortgage Ponzi scheme go undiscovered?

Excerpt from MortgageBusiness.com.au. Questions are being asked about regulatory oversight following allegations that a law firm principal may have misappropriated funds from a mortgage lending scheme. Concerns have been raised about the regulatory oversight of managed investment funds after the Victorian Legal Services Board and Commissioner (VLSB+C) confirmed it was conducting a preliminary assessment into […]

Ponzi Scheme and Mortgage Fraud

“In my opinion there must be Managed Investment Schemes operating in Australia today heavily at risk to slowing developments … at risk of [having] Ponzi-like practices at this very moment. I hope ASIC is watching closely. For those who operate with open and inclusive reporting to investors, and who pulled out of development funding years […]

Good Accountancy and Small Business Restructuring

“…SMEs will face cashflow constraints and may look for equity release solutions to meet ATO and creditor payments. Given the magnitude of mortgage resets due in the next 24 months, these issues are only going to become more prevalent for small business owners…. It is exactly these situations where having a relationship with an established […]

Lowest Fixed Rates

Lowest Fixed Rates for residential properties in metro Sydney, Melbourne and Brisbane (Commercial Loans)

Simple Fixed Rates

Simple Fixed Rates for residential properties in metro Sydney, Melbourne and Brisbane (Commercial Loans)

Ordering Valuations

Semper explains why it may not always be appropriate for a lender to accept a borrower-sourced valuation report, and how you and your customers can save time and money. If you have an urgent settlement Semper will do everything it can to assist. Read on for more information.

Lending while leaving ATO debt unpaid

It is possible to lend to the owners of a company where an ATO debt is outstanding, [but] it is critical for brokers and lenders to establish a trail of discovery that shows plans have been considered to enable the Applicant to pay…