Where will deals actually get done this year?

As the year begins, this is the question many introducers are asking.

At Semper Secured, we have written over $1 billion in private credit across multiple economic cycles, with only five loans ever requiring recovery action. That experience shapes how we see the year ahead and where brokers can add the most value for clients.

Here is our outlook.

Interest rates and funding: what really drives deal flow

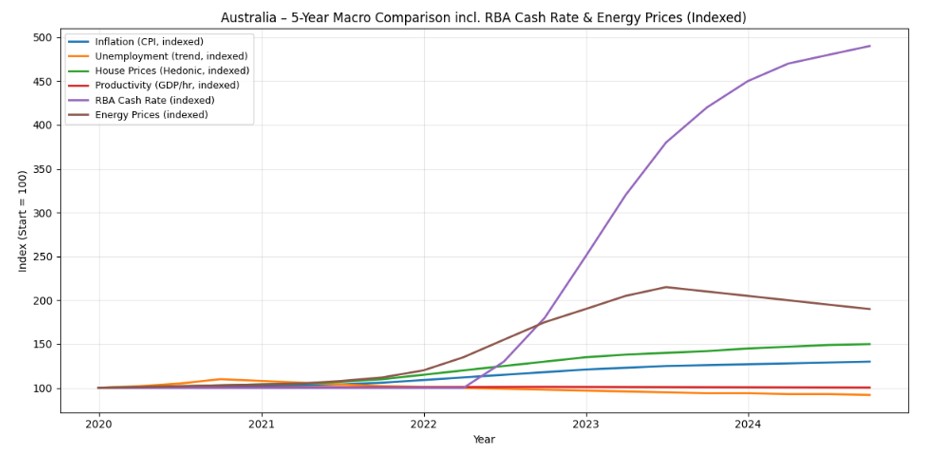

Inflation remains a troublesome factor, but it no longer tells the full story.

-

Employment appears strong, yet much of its growth is driven largely by government and government-funded sectors such as health, education, NDIS, defence, and infrastructure. This keeps headline unemployment low but increases the cost base for taxpayers and does not reflect private-sector momentum or credit appetite.

-

Wage growth driven by public funding is less productive and more inflationary than private-sector investment.

-

Australia’s productivity challenge is not labour or capital, but energy volatility and policy risk. Whether one supports net zero or not, the government’s failure to plan an effective transition keeps energy prices high. When energy costs rise faster than productivity gains, businesses are forced to defend margins rather than expand output, killing sustainable growth.

-

Central banks are increasingly forced to balance inflation control against fiscal expansion rather than relying on organic economic growth. Fiscal expansion adds costs for taxpayers and keeps interest rates under pressure, creating the kind of uncertainty borrowers and markets dislike. Banks remain cautious, slow, and highly process driven.

-

Focusing on economic factors that directly affect business confidence allows us to consider what is likely to influence SME decisions to borrow for growth or to maintain stability through rising costs in 2026. Borrowing decisions are affected by several factors including the cost of funding, real energy prices, employment rates, inflation, and the housing market. These factors interact and influence each other and overall market conditions.

-

Data shows that inflation is not currently being driven by productivity because productivity is suppressed.

-

Households and businesses feel continuous house price increases, rising energy costs, and aggressive RBA rate hikes.

-

Low unemployment does not correlate with improved productivity because most gains in employment have been in the public sector, which is non-productive and a cost burden to taxpayers.

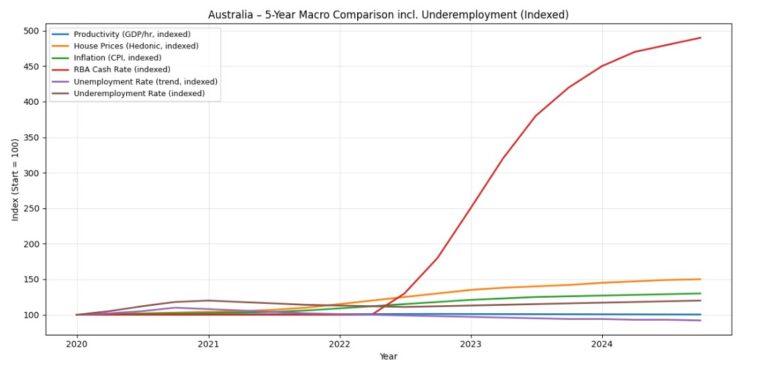

‘Underemployment’ as distinct from ‘Unemployment’ deviates from productivity, which is economically intuitive as it underscores the stagnant nature of private sector work hours that reflects poor productivity growth.

Australia’s productivity remains flat or slightly declining, showing labour is not used efficiently.

This means:

-

People are working, but not enough hours or output to be meaningful.

-

Employers are hoarding labour and cutting hours rather than headcount.

-

Wage pressure remains muted despite low unemployment.

Economic stress shows up in hours and income, not job losses. Australia has achieved low unemployment by spreading work thinly rather than lifting productivity.

Energy costs and cost-push inflation

Australia is effectively sabotaging its own energy supply. Regardless of one’s stance on net-zero, successive governments, not just Labor, have failed to implement a coherent transition strategy to maintain energy supply while renewable networks are brought online. The government’s message that “renewables are cheaper” has little impact as energy prices continue to rise. Several factors contribute to this:

-

Many cheaper coal-fired power stations have been prematurely closed.

-

Investment in transmission lines and energy storage is far below what is needed to connect production sites and store excess energy during periods of high solar and wind generation.

-

Gas production delivers minimal benefit to domestic users. Timor Sea contracts were negotiated during a period of geopolitical uncertainty, resulting in terms less favourable to Australia. This may change in 2026 as the Bayu-Undan Field closes and negotiations to fast-track the Greater Sunrise Fields progress between Australia, Timor-Leste, and Japanese partners.

-

Meanwhile, political focus on virtue signalling and short-term policy wins over pragmatism, leaving Australia’s manufacturing industries and broader private-sector productivity under severe pressure.

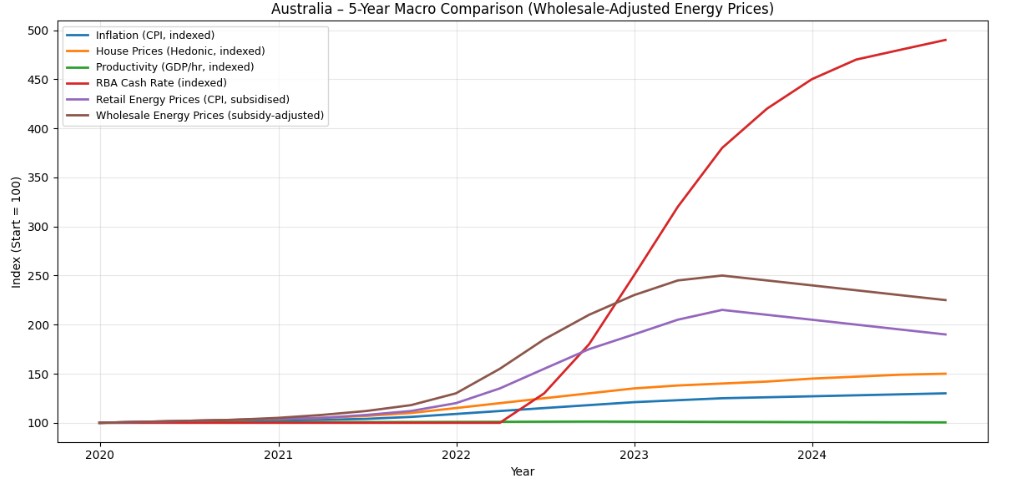

Reliable 2025–2026 data is not yet available, but the trend is clear: fuel prices are the missing link in the inflation story. Overlaying energy prices with other economic indicators shows why inflation surged and why interest rate hikes followed when they did.

Key Points:

-

Energy prices move ahead of both CPI and RBA rate changes.

-

Spikes in energy prices precede:

-

CPI acceleration

-

RBA tightening

-

This is cost-push inflation, not demand-driven. In other words, inflation is not primarily caused by excess spending, but by energy and supply shocks. Rate hikes occur after energy prices rise, pushing CPI higher.

Without a plan to maintain affordable fossil fuel production during the transition to renewables, monetary policy alone cannot lower energy input costs. The only mechanism left is suppressing demand, which effectively taxes household expenditure and limits SME and industrial productivity.

In response to rising energy costs, the Albanese government introduced household subsidies. However, these measures did not extend to SMEs or industrial users, and with subsidies due to end soon, households are facing a looming cost pressure crisis.

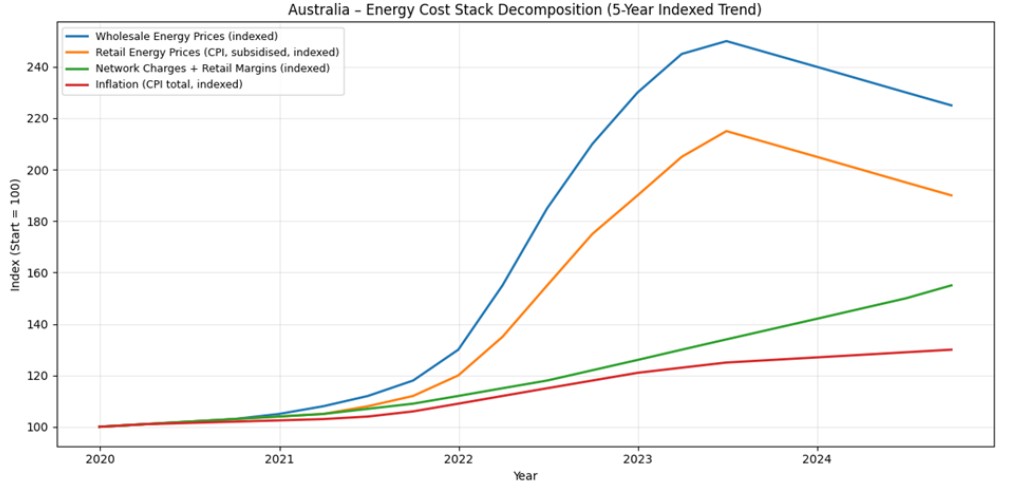

When comparing wholesale and retail energy prices, a significant gap becomes apparent. This is not due to efficiency gains or cost savings, but government subsidies. While headline CPI figures may appear lower, the underlying cost of energy inputs remains high. In effect, this is political management of symptoms rather than a solution to the structural issues in energy supply.

Households are justified in feeling that, despite subsidies, they have not experienced meaningful relief. The reason for this becomes clear upon closer examination.

Energy prices have eased from their 2023 peak, and retail subsidies have naturally followed this trend. However, network charges, including transmission costs and retail margins, have increased more than the decline in energy prices. The result is a continued upward pressure on energy budgets.

Industry and businesses that do not benefit from government subsidies continue to bear what can only be described as an energy productivity tax. Rising energy costs force businesses to defend prices as profits shrink. Consequently, energy expenses contribute directly to inflation and create ongoing pressure on productivity.

Property prices: why Australia stands apart

Australian residential property prices have continued to rise, even as markets like the UK and Canada soften, while commercial and industrial markets also remain strong.

But why is Australia’s residential market defying economic trends?

-

Net migration continues to create strong housing demand.

-

Construction remains constrained by labour shortages, insolvencies, and planning delays.

-

Banks remain selective in funding construction and transitional assets.

Unlike Canada and the UK:

-

Australia has tighter housing supply.

-

Longer loan tenors and stronger household balance sheets.

-

Less forced selling pressure.

What this means for brokers: Lenders are likely to maintain confidence in real property values throughout the foreseeable lending cycles.

Wages and cash flow

Real wages have only recently turned positive. Households and businesses are still repairing balance sheets, while banks are increasingly conservative on serviceability and policy interpretation.

What this means for brokers: Good assets and strong borrowers do not guarantee rapid bank approval. Private credit remains essential where speed, certainty, and flexibility matter.

Where private credit fits

Private credit is not a substitute for standard residential lending. It works best in situations requiring:

-

Rapid drawdown

-

Business acquisition or expansion

-

Time-sensitive property purchases

-

Bridging finance

-

ATO debt consolidation or settlement

-

Partner or shareholder buy-outs

-

Capital restructuring

-

Pre-development and transitional assets

Any situation requiring speed, flexibility, and certainty is where brokers can win trust by solving problems banks cannot.

The Semper difference

Our approach remains consistent across economic cycles:

-

Real asset security

-

Honest pricing without surprises

-

Sensible leverage

-

Clear exit strategies and support when circumstances change

-

Fast, direct credit decisions

-

Transparent terms and execution certainty

-

Cooperative approach when tenures extend or plans change

We work with introducers who value relationships over transactions and appreciate a lender that delivers on its promises. If you have a deal that does not fit within a bank’s box, we are happy to talk it through, and the earlier, the better.

Sources

-

Australian Bureau of Statistics – Consumer Price Index (CPI)

-

Australian Bureau of Statistics – Residential Property Price Indexes

-

Australian Bureau of Statistics – Estimates of Industry Multifactor Productivity

-

Australian Bureau of Statistics – Labour Force, Australia – Underemployment

-

Reserve Bank of Australia – Cash Rate Target & Interbank Overnight Cash Rate

-

Australian Bureau of Statistics – Consumer Price Index: Electricity & Gas

-

Australian Energy Regulator – Network Charges & Retail Margins

Commercial lending

Semper is a leading non-bank lender specialising in property-secured loans to businesses in any industry with loan sums from $250K – $30M 1st and 2nd mortgages Australia-wide up to a maximum LVR of 80%.

Semper offers a wide range of flexible products tailored specifically for you. We specialise in all your short-term and bridging finance needs.

We don’t do loans the banks won’t, but assist when the banks can’t, usually due to timing or circumstance.

COMMON LOAN USES

Rapid property acquisition pending alternate finance;

Managing cash-flow challenges, such as:

- Tax liabilities and ATO debt

- Replacement finance or deleverage from an existing lender

- Pre-insolvency issues/ release from administration and turnaround

- Creditor payments

- Release of equity

- Debt refinancing

- Seasonal trends

- Business emergencies

- Bridging the gap between sale and purchase (residential or commercial)

- Rapid drawdown and equity release

- Buying a business

- Meeting the capital needs of a growing business